Exploding UK Inflation: Imminent Recession?

|

According to UK Office for National Statistics information released on Wednesday, 16 August 2022, the consumer price index increased by 10.1%. (yoy). This result increased from 9.4% in June and was higher than the 9.8% Reuters consensus projection.

Energy, food, alcohol, and tobacco are not included in core inflation, which for the year ending in July 2022 was 6.2%. Increasing from June's 5.8% and exceeding forecasts of 5.9%.

The highest percentage of the yearly inflation rate between June and July was caused by rising food prices. However, a significant amount of fuel also contributed to the increase.

Additionally, consumers are struggling with rising household costs. The lack of decisive political action only serves to worsen the situation.

According to Dan Howe, Head of Investment Trust at Janus Henderson, "today's inflation data serve as another another warning to many UK consumers that they are facing a period of substantial financial struggle."

According to Kien Tan, director of retail strategy at PwC, supermarkets are forced to pass on price hikes from suppliers since they are facing unprecedented escalation in the cost of raw materials and material inputs.

|

| Charts: united kingdom inflation |

As is well known, concerns about a recession have been stoked by low financial conditions, energy difficulties, and food prices. Stagflation is a condition in which there is high inflation and a tendency for economic growth to stagnate or even slow down.

The current global economic recovery following the pandemic of two years ago is threatened by the conflict between Russia and Ukraine. Due to the two nations' significant commodity exportations, the cost of food and energy has increased, "making living more difficult for many people around the world."

Inflation will then be out of control, reducing consumer spending and business profits. The Russian invasion on Ukraine since February 2022 has increased energy prices, which has affected the British economy.

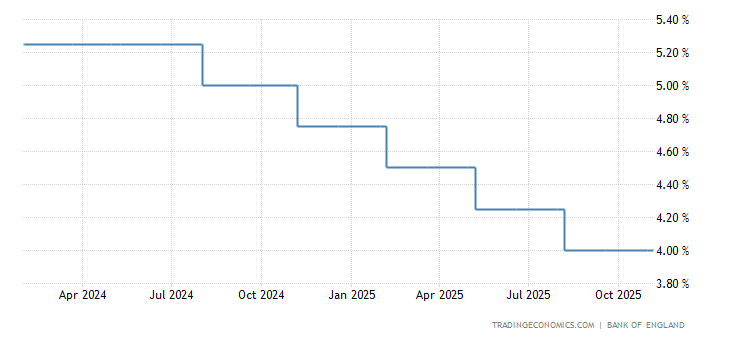

The Bank of England (BoE) has issued a warning that if interest rates are raised by the most in 27 years, the UK will enter a recession. In the end, rising inflation forced the British central bank to boost its benchmark interest rate once more, setting a new record.

|

| Inflation |

The benchmark interest rate was raised by 50 basis points (bps) by the BoE to 1.75%, the highest level since 1995. The increase in the benchmark interest rate was caused by changes in inflation and the value of the pound.

This outcome meets market expectations. According to a Reuters market consensus report, Governor Andrew Bailey and company are also anticipated to increase the benchmark interest rate by 50 basis points.

This course of action was pursued to control the inflation increase and maintain the stability of the British economy. The nation's GDP is predicted to contract in the final three months of this year and keep declining through the end of 2023, and for good cause.

According to information made public on Friday, the UK GDP shrank in the second quarter (Q2) 2022. Due to the staggering increase in living expenses, the GDP shrank by 0.1% from April to June.

The GDP during the first quarter (Q1) was 0.8%.

|

| United Kingdom Interest Rate |

According to the Office for National Statistics, the drop in service output was a major factor in the contraction. The largest barriers are social work and health-related tasks.

This is also because Covid-19-related activities have decreased. In the second quarter, household consumption decreased by 0.2%, it was stated.

According to Hussain Mehdi, macro analyst and investment strategist at HSBC Asset Management, as stated by CNBC International, "The United Kingdom is suffering slow growth as the economy faces hurdles from severe real income pressures amid growing inflation and increased interest rates."

The BoE issued a warning last week, predicting that the fourth quarter of 2022 will see the UK economy experience its longest recession since the global financial crisis. In the meanwhile, a high in inflation above 13% is anticipated for October.

The dynamics of the pound sterling exchange rate are a problem for the BoE's UK economic development in addition to inflation. Since the end of 2021 (year to date), the British pound has fallen by about 10% against the US dollar.

Post a Comment

Comment wisely!